45+ what suze orman says about reverse mortgages

At the time of her husbands death Carol had 53000 remaining on her. Web 39K views 178 likes 10 loves 71 comments 97 shares Facebook Watch Videos from Suze Orman.

Why Suze Orman Hates Reverse Mortgages

The longer a loan lasts the more it costs overall in terms of total interest fees.

. At the time of her husbands death Carol had 53000 remaining on her. Web Suze Ormans Women Money Ask Suze KT Anything. Web You can take out a reverse mortgage starting at age 62 but Orman says thats risky.

Under those terms if the employee contributed 3000 the employer would kick in another. Web Celebrity financial commentator Suze Orman has always had much to say about reverse mortgages. Web The reverse mortgage becomes due in full when the homeowner passes away or moves from the home so if the homeowner is in poor health and finds it necessary to move into a long-term care facility the family is likely to be faced with a difficult decision and additional financial headaches.

Suze Orman has warned homeowners about reverse mortgages - and the risks involved Credit. Todays retirees have been faces with some of the deepest economic crises this country has seen since the Great Depression. Web In a financial advice segment published by CNBC earlier this month adviser Suze Orman addresses a reader question about whether a reverse mortgage is right for the viewer and her husband.

Web Orman spoke of a 71-year-old listener named Carol. Is this a good option. Web The crux of her concerns regarding the product is that older Americans may use a reverse mortgage as a way to temporarily avoid the inevitable that they just cant afford their home.

The site also allows users to find out about approved FHA lenders that offer HECMs and the names of approved counseling agencies. The loan is repaid with interest when you die or sell the house. Reverse Market Insights Jon McCue gives us our latest industry.

The viewer whose husband is considering the reverse mortgage says she is skeptical about the option. Carol has severe COPD and an income of only 1500 to 1600 per month. Web 13K views 91 likes 8 loves 39 comments 39 shares Facebook Watch Videos from Suze Orman.

Web And Orman thinks more folks should consider bucking tradition by going with a shorter loan term. Site has information about HECMs. Web A reverse mortgage is a type of home equity loan for seniors that allows you to receive the money as a lump sum or in monthly installments.

Web Suze Orman on her CNBC show recently responded to a viewer question by stating that a reverse mortgage is a better option than selling stocks. Web A reverse mortgage should only be considered as a last resort. Is that a good option.

Know the risks rewards of reverse mortgages Suze Orman says reverse. Reverse Mortgages Extra Mortgage Payments And Taxes 0000 3758 On this episode of Ask Suze KT Anything Suze answers questions from you all about buying employers stock mortgages retiring outside the US and more. In her view its best to treat a reverse mortgage as a last resort for emergency money and to wait as long as.

The only reverse mortgage option that should be considered is a tenure lifetime monthly payment option. Web Dont get me wrong I think she is colorful and some of her advice is worth following. Carol has severe COPD and an income of only 1500 to 1600 per month.

Web Orman spoke of a 71-year-old listener named Carol. Web Orman says your company might kick in 50 cents for every dollar you contribute up to 6 of your salary. A reverse mortgage means you plan for your heirs to sell the house or turn it over to the bank after your death.

In her podcast Women 26 Money by Suze Orman the money guru took the example of a listener named Carol 71 a widow. During the segment a caller stated that his 85 year old father had been liquidating stocks over the past few years to pay for larger ticket items including the upkeep of his home. Web Orman who describes being contacted by a senior who was not fully aware of the financial implications that accompany a reverse mortgage loan describes for her listeners how important it is to self educate as much as possible before becoming involved in a complex financial product.

Web His recommendation is that older homeowners consider a reverse mortgage as an emergency fund of last resort during retirement rather than a major part of a retirement plan. Editorials24 summarizes her recent financial advice on money mistakes to avoid and one is to not get a reverse mortgage in your 60s Other Stories. You can take out a reverse mortgage starting at age 62 but Orman says thats risky.

Web Operates the federal Home Equity Conversion Mortgage HECM reverse mortgage program. However there are times when Suze is dead wrong and if you ask me her advice on reverse mortgages is one of those instances. My 63 year old mom is interested in a reverse mortgage.

These home loans allow homeowners to convert their home equity into cash income with no monthly mortgage payments. My 63-year-old mom is interested in a reverse mortgage. Web Financial guru Suze Orman suggests reverse mortgages be used only as a last resort.

Web SUZE Orman has issued a warning to homeowners and explained the risks of reverse mortgages.

Suze Orman You Need At Least This Much To Retire Early Money

Watch The Suze Orman Show Season 2006 Prime Video

Suze Orman Says These Are America S Common Money Mistakes The Wealthadvisor

Suze Orman Savings Advice How To Save More Money

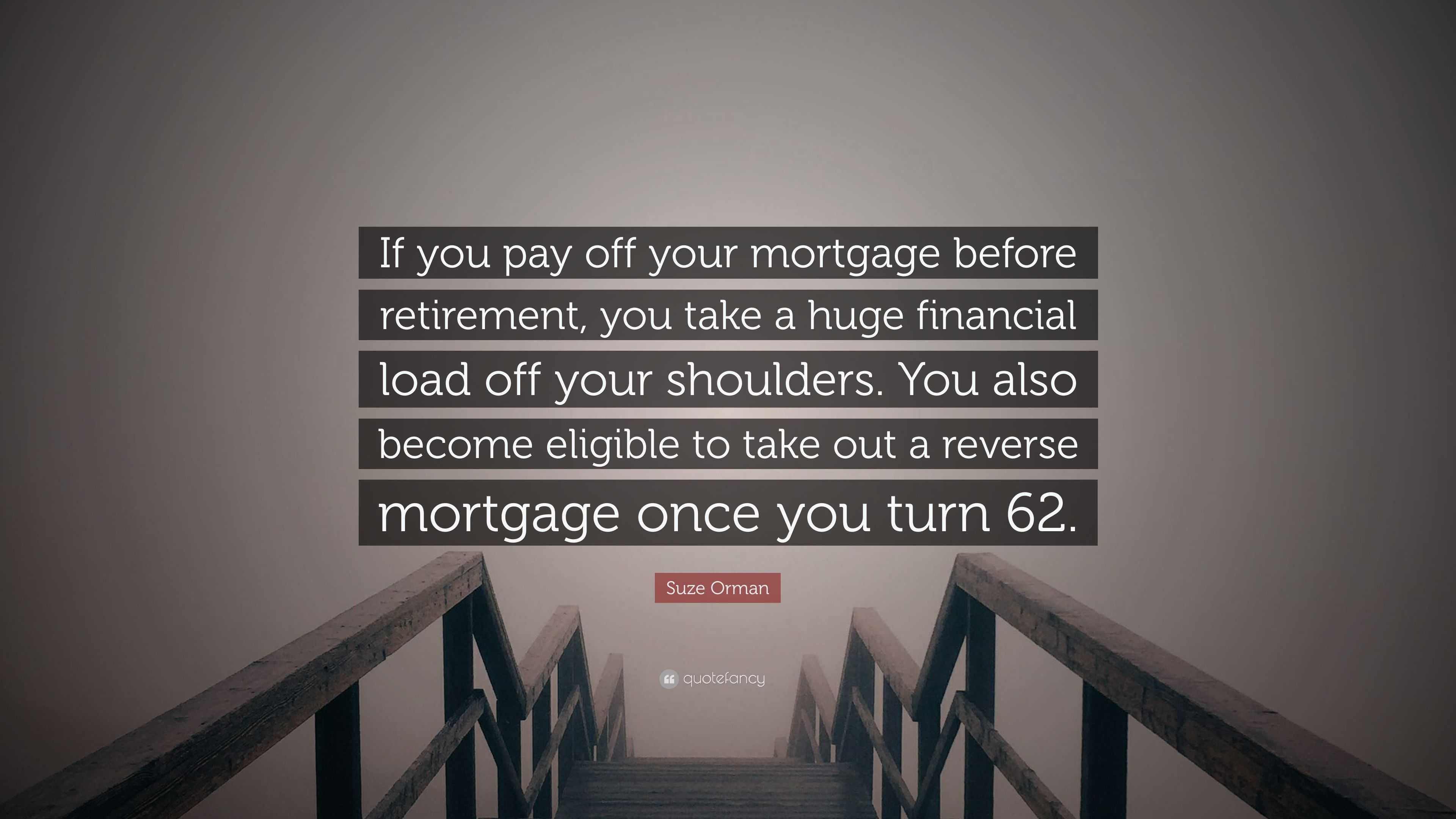

Suze Orman Quote If You Pay Off Your Mortgage Before Retirement You Take A Huge Financial Load Off Your Shoulders You Also Become Eligi

Comparing Fixed Rate And Adjustable Rate Reverse Mortgages Mls Reverse Mortgage Powered By Zyng Mortgage

Reverse Mortgages Know The Risks And Rewards

Suze Orman S New Rules For Retirement Money

The Money Class How To Stand In Your Truth And Create The Future You Deserve Orman Suze 9780812982138 Amazon Com Books

Suze Orman Says Don T Make These Costly Money Mistakes

There Are No Loans For Retirement Suze Orman Warns To Avoid These Blunders So You Can Live Your Best Retired Life

What Are Reverse Mortgages And Do They Target The Elderly Are Reverse Mortgages Good For Seniors Oppu

Suze Orman Savings Advice How To Save More Money

Suze Orman Quote If You Pay Off Your Mortgage Before Retirement You Take

Suze Orman Issues Important Mortgage Warning And Explains The Risks Of Reverse Home Loans The Us Sun

Suze Orman S Roth Ira Strategy Can Help With Emergencies Money

Death Reverse Mortgages And Heirs Mls Reverse Mortgage Powered By Zyng Mortgage